- Home

- Tools & Services

- Services

- Legal Entity Identifier - LEI

Loading...

Legal Entity Identifier - LEI

Secure your LEI registration & financial transactions with GS1.

GS1 is a GLEIF (Global Legal Entity Identifier Foundation) accredited Local Operating Unit (LOU), and is authorised to offer a complete LEI service, globally.

Obtain an LEI from GS1 for just €89 plus VAT

The initial registration fee for an LEI, through GS1 Ireland, is just €89 plus VAT with an annual renewal fee of only €59 plus vat. You can transfer an existing LEI to GS1 Ireland to avail of the excellent value renewal fee. No renewal fees are payable until the renewal due date.

Click to apply for an LEI

What is an LEI and other Frequently Asked Questions

LEI stands for Legal Entity Identifier.

An LEI is used to identify companies active on financial markets. It is an alphanumeric code consisting of 20 digits.

An LEI delivers transparency and security of entity identification among financial parties, enabling traceability of the transactions. Use of an LEI is mandatory for any organisation subject to the EMIR reporting requirements.

Through GS1 Ireland you can apply for a new LEI or transfer or renew an existing LEI.

All prices are exclusive of the statutory value-added tax.

|

LEI single application (one-year term) |

€89 |

|

LEI renewal (one-year term) |

€59 |

|

LEI collective application (min. 10 LEIs, one-year-term) |

|

|

LEI collective renewal (min. 10 LEIs, one-year-term) |

|

|

LEI account change |

€0 |

|

LEI Transfer Fee |

€0 |

LEI Fees and GLEIF Contribution

The annual provision fee for using the Legal Entity Identifier (LEI) includes a contribution for the Global LEI System (GLEIS contribution). The GLEIS contribution is used to finance the GLEIF in its capacity as central institution. GS1 pays this contribution at the current amount of €14.50 directly to GLEIF. Legally independent entities and participants with independent accounting (from industry, commerce, the service sector etc.) are required to pay a fee.

|

Global issuing agency with local support |

Simple and clear LEI registration process |

Effortless, free of charge LEI transfer |

Competitive market pricing |

GS1’s LEI services can help you with obtaining, transferring and renewing your Legal Entity Identifiers (LEIs). Easy LEI registration Simple and clear LEI registration process Simple LEI transfer Effortless, free of charge LEI transfer Competitive prices for LEI applications Competitive market pricing

With more than 40 years of experience in the identification of unique products and entities, GS1 and its global network of 112 Member Organisations are uniquely qualified to offer complete LEI services, with expertise in data validation and knowledge of local language, laws and regulations.

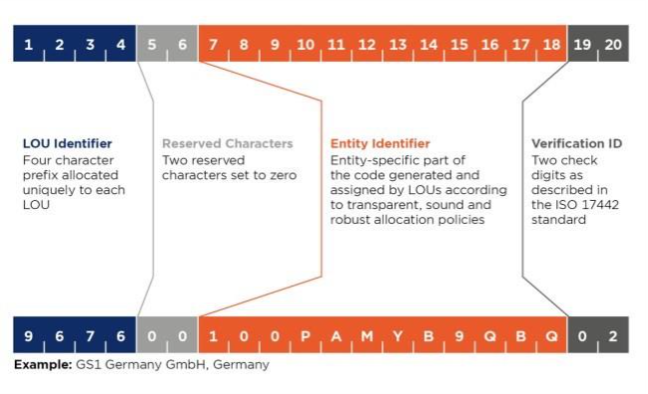

LEI 20 character structure

The LEI Code is structured in accordance with the ISO standard 17442 and has a 20 character alphanumeric format.

Sample Code: 9676 00 100PAMYB9QBQ 02

9676: Four character prefix designating the LEI issuing agency - LOU (Local Operating Unit);

00: two-digit separation, temporarily reserved

100PAMYB9QBQ: twelve-digit identification of the legal entity

02: two-digit checksum in accordance with the ISO 17442 standard

Derivatives Trading and the European Market Infrastructure Regulation (EMIR)

Since February 2014 any organisation participating in the trade of derivatives and who is required to comply with the EMIR (European Market Infrastructure Regulation) is required to have a mandatory LEI.

Compliance with the European MiFID II/MiFIR regulation

As of January 2018, in accordance with the new European MiFID II/MiFIR regulation(Art.26 of Regulation nr.600/2014), European financial institutions must notify their national financial services authority / regulator of all transactions carried out relating to certain financial instruments.

Each legal entity, active in trade of financial instruments offered on a trading platform (or underlying products being exchanged on a platform), such as shares, bonds, warrants, state loans, warrants, state loans and state notes is required to be identified with an LEI. (This measure does not apply to some investments, investment insurances, term deposits, deposits and savings certificates products.)

All legal entities wishing to purchase or sell one of the above mentioned financial instruments, is required to identify itself by an LEI. The legal entity is responsible for obtaining its own LEI.

GLEIF Accredited Organisations

The issuing of an LEI is subject to strict regulations. Only organisations that have successfully passed the Global Legal Entity Identifier Foundation (GLEIF) accreditation process are entitled to issue LEIs.

Local Operating Units (LOUs)

Accredited parties are called Local Operating Units (LOUs). GS1 Germany is an accredited LOU.

All requests for LEIs received by GS1 Ireland are processed by GS1 Germany. GS1 Ireland is a GLEIF LEI Registration Agent.

The Global Legal Entity Identifier Foundation (GLEIF) was established by the Financial Stability Board in June 2014.

The GLEIF is tasked to support the implementation and use of the Legal Entity Identifier (LEI). The foundation is backed and overseen by the LEI Regulatory Oversight Committee, representing public authorities from around the globe that have come together to jointly drive forward transparency within the global financial markets. GLEIF is headquartered in Basel, Switzerland.

GLEIS stands for Global Legal Entity Identifier System

The Global Legal Entity Identifier System (GLEIS) enables the clear, unambiguous identification of participants in financial transactions.

The basis of the system is ISO 17442. This standard defines the elements of clear legal identification of the relevant legal identities involved in a financial transaction.

Legal Entity Record Data

An LEI data record consists of an ID and its associated data, known as a Legal Entity Record Data (LE-RD).

GLEIS was expanded in 2017 to include data with which connections with parent companies could be mapped.

If a legal entity which has a holding company wishes to apply for a LEI, the relevant data must be provided while applying which, in the simplest case, is the LEI of the holding company.

Further development of the Global Legal Entity Identifier System is carried out by the Global Legal Entity Identifier Foundation (GLEIF) in collaboration with the Local LOUs.

The Global LEI Foundation (GLEIF) is supervised by the LEI Regulatory Oversight Committee (LEI ROC).

GLEIF Database

Each LEI is associated with key data relating to the company and/or fund. This is stored in the GLEIF database.

- Official name of the legal entity or of the fund manager

- Registry name and registry number

- Legal form of the company

- Registered office of the headquarters or of the fund manager

- ISO country code

- Date of first issue of the LEI

- Date of the last change of the saved information

- Due date of the next LEI renewal